|

|

|

Assignment

3: Scenarios, Comparative Analysis,

and Initial Design

- Task

Scenarios

- Revised

Personas and Task Analysis

- Comparative

Analysis

- Initial Design

- Work

Distribution Table

Task Scenarios

Scenario

#1

James reads a news article,

then looks for industry trends and analysis.

|

While

sitting in his MBA class, James skims CNet’s

news website on his laptop. One story grabs his

attention: “Google takes ad service to China.”

He learns that Google will let advertisers in China

bid for keywords in traditional and simplified Chinese.

The article mentions that Sohu reported advertising

revenue of $9.5 million, a 120 percent rise from

last year. Figures and calculations race through

James' mind; he tries to extrapolate the current

market size and imagine how big it will grow over

the next five years. He is curious if there are

companies in China that specialize in Chinese character

search technology. He hopes he can find local partner

with whom he can work together to build a search

engine optimized for search Chinese characters.

He goes

to the Mapping China website where all the information—industry,

market, company, and contact data—is arranged

in a clear and easy to digest interface. He clicks

the industry analysis section where he read a brief

overview of the search engine market in China. He

goes on to select a specific company. The company

page contains a brief description of the company

and its management team. Suddenly, he remembers

meeting the company’s vice-president of marketing

at a trade show a few months ago. He gives the VP

a call to see if he can a better sense of more market

trends.

|

Scenario

#2

Stella researching for class

project

|

Stella needs to write a paper on wireless industry

in China. She knows something about the topic already,

but still, she would like to have a general overview

of the industry and some specific statistics. She

comes to our site, and immediately sees "wireless"

listed under "industries". She clicks on it, and

it takes her to the wireless industry home page,

where she is given several paragraphs about the

industry and tools for her to visualize the information.

She selects bar chart to show the overall growth

of the industry from 1990. Also listed there is

all the major players in the wireless industry sorted

by revenue. She noticed China Mobile has the most

revenue, so she clicks on the company names and

reads more financial data about the company. She

wants to know the number of wireless subscribers

in China. She clicks on "statistics", and found

the 2002 figure. She reads some latest news about

the industry, and she is interested in reading some

analyst reports. She goes to the "resource" section,

and saw a list of websites with both free and paid-subscriptions

where she can get more information. She clicks on

one of them and continues her research.

|

Scenario

#3

Janet wants to find company

and market information for job search

|

Janet

is a 27 year-old graduate student interested in

job or internship opportunities in China. Prior

to pursuing her Masters degree, she worked for several

years as a software programmer. She's therefore

very familiar with the software industry, although

not particular to China. She knows China is the

fastest growing market for high tech and, thanks

to WTO and IP regulations, has been growing its

software industry. Janet has some familiarity with

China, and has an idea of where the major cities

in China are located. She's interested in finding

jobs in Shanghai, which she has heard is the most

international and cosmopolitan Chinese city.

She

has heard about the MappingChina web site from a

friend of a friend and types in the URL in her browser.

After skimming general information on China, she

selects the software industry so she can filter

the information to only that regarding her industry.

She's surprised to see that the software industry

is actually most active in the Guanzhou region;

she notes that there are more software companies

and news stories centered around that region. She

skims through the Chinese government's recent policies

regarding software, including intellectual property

and high tech park initiatives. But because she's

still reticent about life under communist rule,

she decides she's still interested only in jobs

in Shanghai. She reads a few statistics about Shanghai

area, including cost of living and salaries. They're

much lower than what she's used to, but maybe it's

worth a shot. She's still young and China is where

the throngs are amassing (not to mention the dire

job situation back home, given the terrible economy).

Unsure

of what software companies are located in Shanghai,

she zooms in on that province and does a company

search. She clicks through a few company summaries

for both Chinese companies and multinationals, and

even continues on to some of the company Web sites,

where she applies for a few of the openings on their

job pages. UTStarcom is a telecommunications company

that also delves in software. However, their closest

offices to Shanghai are in Hangzhou. She wonders

how far Hangzhou is from Shanghai? Could she live

in Shanghai and commute to Hangzhou? She zooms in

on the map to see the distances and looks up transportation

information for Shanghai. She notes that there's

a regularly scheduled train that goes between Hangzhou

and Shanghai, but it takes 2 hours to get between

the cities.

Taking

a break from this job search tactic, she clicks

on news to see which software companies are making

headlines in China. She clicks on a few news headlines

to read the articles that interest her, including

a few on software outsourcing to China -- evidence

that business is booming, but also that she'll have

some strong local competition. Eventually, Janet

decides to sign up with MappingChina in order to

regularly receive email headlines for the software

industry.

Finally,

she clicks on the Guanxi link to see what software

professional groups and events might lead her to

company contacts to assist in her job search. She

notes a couple that are active in her area (San

Francisco Bay Area) and decides to attend the next

meeting of the Chinese Software Professionals Association.

According to the CSPA Website, they will be welcoming

a speaker soon who will talk about his entrepreneurial

experiences setting up a software startup in China.

|

Scenario

#4

James

looking for possible competitors and partners

|

James

has been chewing over an idea for a new start-up

company that would serve as a liaison between semiconductor

design firms in the U.S. and fabrication firms in

China. He wants to find out if any other companies

are already providing this service and, if so, whether

they would be potential partners or competitors.

He decides to try out a new web portal developed

by some SIMS students. He settles at his computer

after dinner one night to do the initial research.

He brings

up the web portal and browses companies in the semiconductor

industry, seeing that they’re mostly located

in Shanghai. This makes him curious about the development

of the industry in China over time, so he looks

at that. He then looks through current news stories

on the industry and on specific companies. For companies

that catch his interest, he looks up service type

(design house, fabricator, etc.), specialization

(consumer product chips, computers, servers), parent/subsidiary

relationships, statistical information – size,

financial data – and website link (if any)

for a company contact. After about an hour and a

half, James has found and printed out information

on a few companies that he will ask his colleagues

about at an upcoming conference on high-tech development

in Asia. Satisfied, he checks his email quickly

before logging out and going to bed.

|

|

Revised Personas and Task Analysis

We

added 1 more persona because our interviews indicated

that the main users would be business-savvy students and

professionals looking to get involved in the high tech

market in China. Therefore we conducted an extra exploratory

interview with an MBA student to verify that there is

a demand for the Mapping China tool among that demographic

group.

Persona

#4 James Kwong

30-year-old second-year male MBA student |

|

James

is an aspiring technology entrepreneur who is thoughtful

and directed. After receiving his bachelor’s

and master’s degrees in electrical engineering,

James worked as a computer chip designer before

moving over to product marketing and sales, where

he found his true calling. His goal after graduating

is to start his own business – he has many

ideas for high-tech services, applications, and

products that he would like to develop and market.

He is interested in the high-tech market in China

because that’s where the greatest opportunities

are taking place.

Although

he was born in Taiwan and speaks Taiwanese and some

Mandarin, James’ family moved to the United

States when he was very young, so he considers English

to be his native language. He feels most comfortable

and confident communicating in English for business

purposes. For this reason, he wants to interact

primarily with the U.S. affiliates of Chinese companies,

since GuanXi and speaking Chinese are essential

to doing business with Chinese companies.

When

he first got into marketing and sales, James attended

many networking events and conferences. Now that

he is more knowledgable about the field, he doesn’t

go to as many events, but his contact network is

still a primary source of industry information.

When James hears about a trend or wants to learn

more about a particular company, he will do some

basic internet research and then call up people

he knows to get more information. James wants to

know more about the smaller high-tech companies

in China as well as who they’re affiliated

with in the U.S. so that he can evaluate them for

partnerships or as competitors. He plans to live

and work in the U.S. but travel to China regularly.

James’

Goals

•

Understand the interrelationships among American

and Chinese companies

• Find out a particular company’s specialization

• See where industry concentrations are located

geographically in China

• Find out who the key players are in each

industry

• Get contact information for companies, both

American and Chinese

• Find out information on professional organizations

in China

• Use a China MapQuest to help |

|

Revised

task analysis:

|

|

|

|

|

| Task

Frequency |

Janet

Chen |

Stella

Ling |

James

Kwong |

Scott

McIntyre |

| Scan

for news about high-tech China |

|

|

|

|

| Skim

mainstream periodicals |

hi |

hi |

me |

me |

| Sign

up for targeted newsletters |

me |

me |

me |

hi |

| Read

discussion boards and weblogs |

hi |

lo |

lo |

lo |

| Research

specific industries and companies |

|

|

|

|

| Search

Google |

hi |

me |

me |

me |

| See

who key players are |

hi |

hi |

hi |

hi |

| See

relationships among companies |

me |

hi |

hi |

hi |

| See

where industries are located |

hi |

me |

hi |

hi |

| Get

company contact information |

hi |

lo |

hi |

hi |

| Get

stats from government websites |

me |

hi |

hi |

me |

| Read

market research reports |

me |

hi |

me |

me |

| Compare

news and analysis for reliability |

|

|

|

|

| Collect

data from multiple sources |

me |

hi |

hi |

hi |

| Ask

contacts in the field |

lo |

hi |

hi |

hi |

| Evaluate

credibility of source |

lo |

hi |

hi |

hi |

| Network

with industry insiders |

|

|

|

|

| Attend

trade shows/conferences |

lo |

hi |

me |

hi |

| Locate

trade associations |

lo |

hi |

hi |

hi |

| Find

travel information |

hi |

hi |

me |

lo |

|

|

|

|

|

Comparative Analysis

Competitor

#1

|

Telecomasia.net |

WHAT:

Telcomasia.net is an online news and research portal

catering to professionals in the telecommunications

industry in Asia.

DESCRIPTION:

A publishing company based in Hong Kong operates

this portal as an extension to its print business.

The portal consists of three main components: news

headlines, company and industry directories, and

research resources.

AUDIENCE

Telecommunications industry professionals

POSITIVES

- Overall the user interface is straightforward,

allowing users to skim news and get to analyst reports

with just a few clicks.

- Every page in the website has the same layout.

- The uniform layout allows users to focus on the

main content as they browse through the site.

- The menu is a visible and consistent navigation

element that effectively guides users as they move

from page to page.

NEGATIVES

- The left menu contains over 30 items divided by

categories headers

-

The company directory section is populated with

only barebones information.

- The user goes in expecting to find company descriptions,

statistics, and various other data, but telecomasia.net

does not provide such detailed information.

- Telecomasia.net relies on companies to input their

own data.

- The only way for a company to submit its data

is via a PDF form, which defeat the whole purpose

of web-based information exchange

The

research resources area breaks down the telecom

industry into a hierarchy of equipment and service

providers. The arrangement of these categories anticipates

what topics users will look for as they browse.

This directory serves as a reference for Mapping

China to breakdown the high-tech industry.

|

Competitor

#2

|

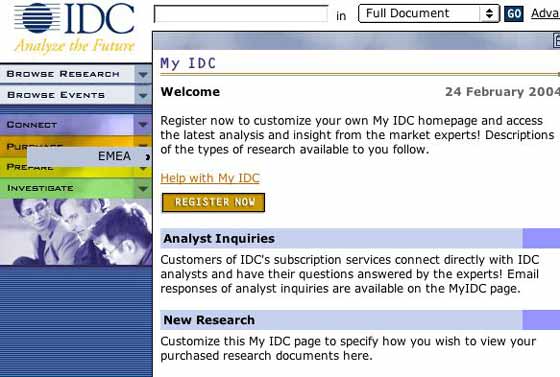

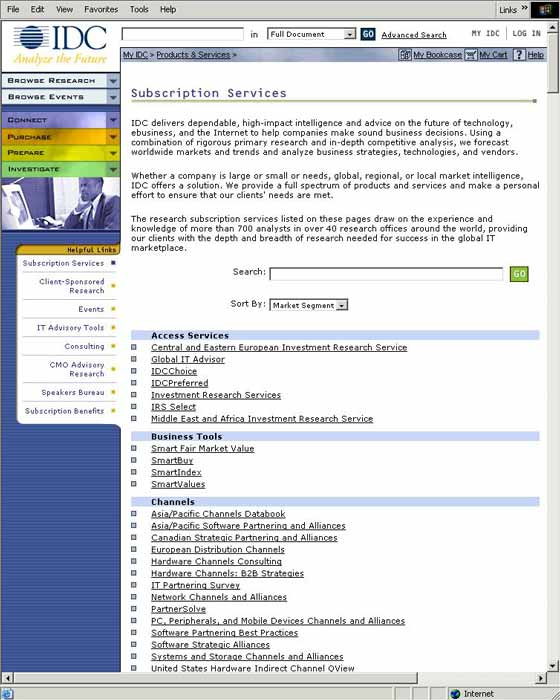

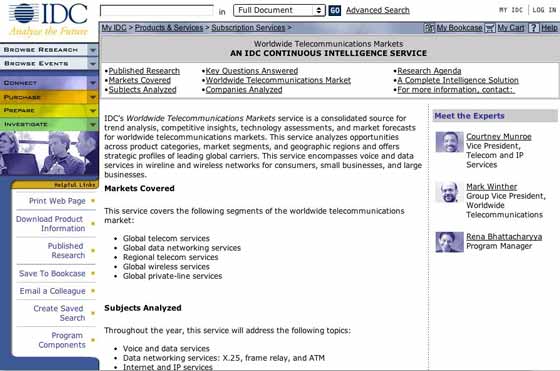

IDC

(International Data Corporation) |

WHAT:

IDC (International Data Corporation) Market Analysis

for worldwide telco market

DESCRIPTION:

Industry-specific market analysis portal (Paid service)

http://www.idc.com/getdoc.jhtml?containerId=IDC_P595

AUDIENCE

- Primary: Marketing professionals (Account Managers,

business

development), industry professionals

User Objectives: track industry news, information,

activity

- Secondary: Other people interested in the telco

market

User Objectives: track industry news, information,

activity

PURPOSE

- repository for market analysis, industry research

- e-commerce site to purchase such research

- advertise IDC services (get new customers for

consulting, analyst briefings, etc.)

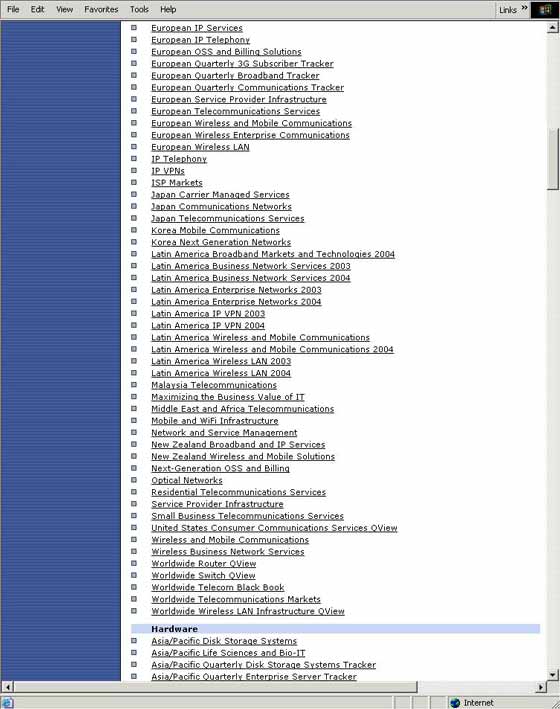

CONTENTS/FEATURES

- secure log-in view as well as browse view (can

view abstracts, search)

- Customizable views with user registration

- Free newsletter (with registration)

- IDC RSS feeds to user desktop

- Browse research (by business area, geo, strategy,

technology)

- Browse events (all upcoming, by region, by event

type)

- Content Management System (CMS): Upload/download

documents

- IT advisory Tools (SmartIndex to help set competitive

pricing,

SmartBuy for procurement, etc.)

- Benefits of registering spelled out clearly

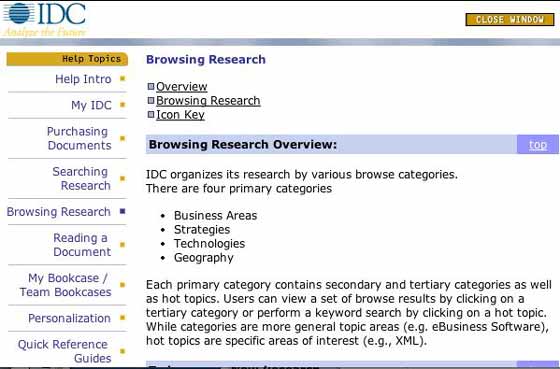

- Help is available -- some is task based, with

a handful of screen

shots for part of it

- data/analysis objectivity disclaimer

- request for analyst briefing

- side bar for recent IDC press releases, for Featured

Research

- Quick link to request to quote IDC (Web-based

form)

- Contact IDC (including listing of brick-and-mortar

offices)

POSITIVES

- Purpose of the site is clearly stated on homepage

- Main functionality of site is intuitive on homepage:

personalization

"My IDC", Login, it's a paid service (shopping

cart), Subscription, How To (Create a Business Plan,

etc.) services,

- Credentials displayed up front (Meet the Experts,

analyst teams, etc.)

- Possible personalization of site, including remote

storage

(Bookcase), saved searches - Search tool with filter:

by document identifier, author, company, geo, event,

topic, language (English or Japanese)

- Search tool has sort feature (published date,

title)

- Advanced features available (e.g. advanced search)

- all documents are labelled with date and author

- documents have summaries (abstracts)

- printer-friendly format available

- document summaries and Table of Contents available,

even without user registration

- site index/site map

- Web forms "remember" content typed in

them if user navigates back and forth (even without

completing "submit") -- did they use cookies?

NEGATIVES

- User experience: random javascript components,

some of which don't work on some platforms (like

my Mac, Unix), also some text formatting problems,

ghosting of UI objects (remnants that stay long

after your mouse is no longer on the GUI object)

- Content: Some menu choices are abbreviated (unfinished);

redundant bits lead to unnecessarily text-heavy

pages

- Information Architecture: no clear flow of data;

many menus

distributed all over home page

- Terminology: what is a "Bookcase" ?

(never answered, but you need to be a registered

user to use it); Inconsistent naming scheme of IT

Advisory Tools, data formats

- (side bar) IDC press releases, Featured Research

titles are not

related to the Telecomms industry

- Help removes button bar: how to go back?

- Help has 2 lists of options (help topics, and

sub topics per each). But help topics are a mix

of feature and task

- Cannot resize help window (but you can scroll);

window chops off some Help Topic options

- Help doesn't cover many topics - is it comprehensive?

- RSS feeds non-intuitive (complex, non-intuitive

techie process -- for marketing people -- involving

XML, cutting and pasting URLs)

- It's not clear how to use the IT Advisory tools

(can you link to

them? Do you have to pay for them? Do you have to

pay for an IDC analyst to use them and then deliver

the results to you?) Two layers into the Tools page,

I still don't know...(You have to call them to set

up an appointment in order to find out more!)

- link to jobs at IDC -- seems inappropriate here

- seems a little slow (I don't know if this is general

network traffic

or specific to their site)

|

Competitor

#3

|

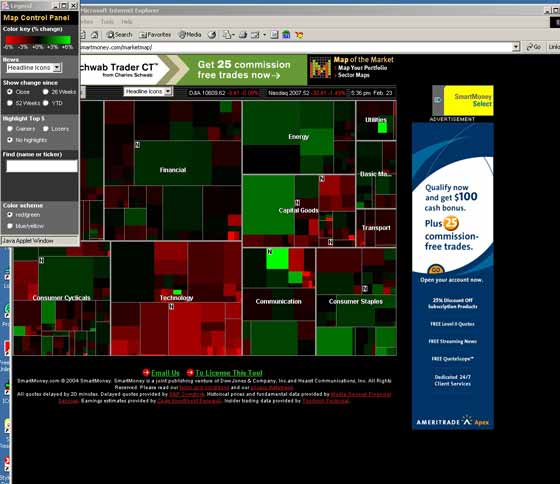

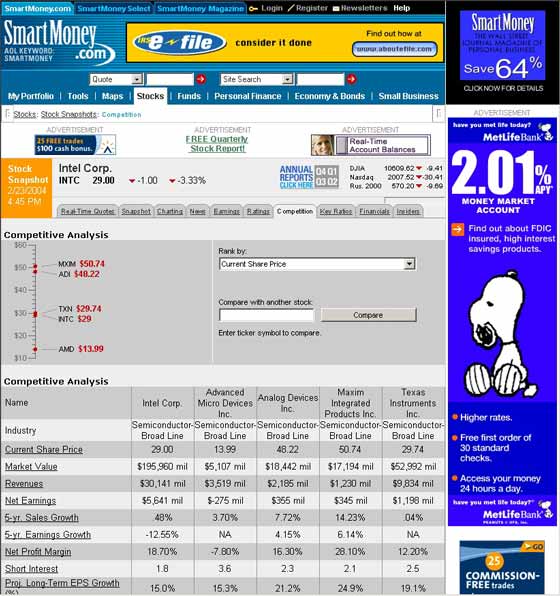

SmartMoney.com |

|

WHAT

SmartMoney.com Maps Feature (http://www.smartmoney.com/maps/?nav=DropTabs)

DESCRIPTION

Visualization tools and related information on company

and industry performance.

AUDIENCE

- Primary: Individual stock and mutual fund investors.

User objectives: see “hot” and “cool”

spots in industry, see current stock prices of companies

by industry, see size of companies in relation to

other companies in same industry, track company

performance over time, see who a company’s

competitors are, get recent news on companies and

industries.

PURPOSE

- Offer free and subscription-only investment information

services for U.S. and international companies

CONTENTS/FEATURES

- Visualization of companies and industries

- Visualization of companies within an industry

- News stories by company and industry

- Financial information on each company: stock price,

stock volumes and high/lows, graphs of performance

over time, earnings, ratings, competitors, key rates,

financials

- Free information on 600 stocks

- Subscription services for 1000 U.S. and international

stocks

- Mutual fund map

POSITIVES

- Visualizations very effective at depicting company

size and performance

- Easy to get a quick overview of industry performance

- A lot of good information on individual companies

- Icons in company boxes let users see which companies

have “news”

- Vertical hierarchy competitor graphs good way

to visualize performance relationships

- Site is customizable – users can track and

visualize their own stocks

- Maps are accessible for new users; by moving the

mouse around, users quickly see how the maps work

- “Find” function offers like names

when user begins typing a name

- “Find” search result consists of highlighting

relevant box on map and bringing up additional information

pop-up

NEGATIVES

- Must click through many screens to get information

- Screens come up as individual panes that must

then be closed; can’t use the “back”

button

- Company information is stock-oriented

- User must enter billing information before being

allowed a trial 2-week subscription

- Control panel for the map visualizations is separate

from the map; easy to lose it behind open panes

- Maps can be overwhelming at first sight –

one doesn’t have an immediate frame for using

them

- Information that could easily fit on one pane

is spread out over multiple panes (probably to allow

for advertising)

- Distracting animated ads and pop-ups

- News icon sometimes obliterates small companies

on the map

- “Find” search result highlight box

hard to distinguish from industry outlines

- Map discriminates against small companies, since

some are depicted as no larger than a dot

Main

map of all industries:

Company

information (Intel):

Competitive

analysis (Intel):

|

|

|

|