|

|

|

Assignment

9: Third Interactive Prototype (Final

Writeup)

- Problem

statement

-

Solution Overview

-

Personas and Scenarios

-

Describe the Final Interface Design

- Describe the

functionality

- Provide a

description of the main parts of the interaction flow.

- What was left

unimplemented?

- Tools you

used to develop the system

- Design

Evolution

- Describe how

your UI changed from initial sketches, low-fi testing,

HE, and final usability test.

- Show what

the major changes were and why they were made.

- Describe which

of the three evaluation technique (low-fi prototype run-through,

heuristic evaluation, pilot

- usability

test) was most valuable to your prototypes usability and

why.

- Link

to class presentation [download

the *.ppt]

- Work

distribution table

|

1.

Problem statement

2.

Solution Overview

For

purposes of demonstrating our project, we have created

a web site that interacts with a database to extract

and display industry, sector, and company data. We feature

overviews and discussions of trends for industries and

sectors, lists of key players, market breakdowns by

sector and company, and company data (descriptive text,

statistics such as location, URL, stock ticker symbol,

market capitalization, and number of employees, and

top competitors).

Our interactive data visualization tool lets users explore

the following relationships:

• Competitive relationships (companies providing

products and services with similar features targeting

the same market);

• Joint venture relationships;

• Mergers, acquisitions, and divestitures;

• Strategic affiliations between companies; and

• Contractual relationships (companies licensing

major products or services from other companies).

With our tool, users can get an overview of:

• The different sectors in an industry;

• The major player(s) in those sectors;

• How one sector compares to another in terms

of market capitalization and number of companies;

• How sectors are related (i.e., do the companies

in one sector have relationships with companies mainly

in another sector?); and

• Those companies with more relationships than

others.

Users can also view deal specifics (dollar amount, date

of inception) and product names and descriptions.

Our visualization will help users see non-obvious information

that cannot be found easily using text-based tools,

such as the patterns of relationships companies or sectors

have with other companies and sectors, and which sectors

offer the best entry to the industry.

3.

Final Personas and Scenarios

We

targetted young entrepreneurs specifically because they

-

tend

not to have very many contacts in the field (in China)

or in-depth familiarity with the domain,

-

limited

funds to afford the access fees to the expensive market

research databases and industry reports

- need to

move very quickly in targetting niche markets, partners

and potential solutions.

Our

sample users reflect different needs for data and diagrams,

language limitations, and degrees of knowledge of China.

Our personas try to address each of these parameters.

Below is the persona of our lead user, “James

Kwong.”. Our primary and secondary users share

several characteristics, including a lack of trust in

online data that does not come with explicit credentials,

the desire for quick, graphical data overviews, and

the capability to drill down for more details.

Persona

James

Kwong

30-year-old second-year male MBA student

James

is an aspiring technology entrepreneur who is

thoughtful and directed. After receiving his bachelor’s

and master’s degrees in electrical engineering,

James worked as a computer chip designer before

moving over to product marketing and sales, where

he found his true calling. His goal after graduating

is to start his own business — he has many

ideas for high-tech services, applications, and

products that he would like to develop and market.

He is interested in the high-tech market in China

because that’s where the greatest opportunities

are taking place.

Although he was born in Taiwan and speaks Taiwanese

and some Mandarin, James’ family moved to

the United States when he was very young, so he

considers English to be his native language. He

feels most comfortable and confident communicating

in English for business purposes. For this reason,

he wants to interact primarily with the American

affiliates of Chinese companies, since GuanXi

and speaking Chinese are essential to doing business

with Chinese companies.

When he first got into marketing and sales, James

attended many networking events and conferences.

Now that he is more knowledgable about the field,

he doesn’t go to as many events, but his

contact network is still a primary source of industry

information. When James hears about a trend or

wants to learn more about a particular company,

he will do some basic internet research and then

call up people he knows to get more information.

James wants to know more about the smaller high-tech

companies in China as well as who they’re

affiliated with in the U.S. so that he can evaluate

them for partnerships or as competitors. He plans

to live and work in the U.S. but travel to China

regularly.

James’ goals:

• Understand the interrelationships among

American and Chinese companies.

• Find out a particular company’s

specialization.

• See where industry concentrations are

located geographically in China.

• Find out who the key players are in each

industry.

• Get contact information for companies,

both American and Chinese.

• Find out information on professional organizations

in China.

• Use a China MapQuest to help.

|

Scenario

James

is a 30-year old enterprising first generation

Chinese-American. He moved with his family t from

Guangzhou, China to Michigan when he was 13. James

completed his MBA a year ago, after working for

4 years as a software engineer at an Internet

software company. During his MBA, he flushed out

the business plan for a software game idea on

the mobile phone platform, and befriended a couple

of Chinese-American engineers with whom he’s

been working on creating a startup to launch this

game. They would like to launch the idea in China,

as its both a strong mobile gaming market, and

because of his team’s advantage knowing

the language and culture.

As

the strategy guy for his team, he wants to find

out what companies are active, and especially

those leading the market, in China. He wants to

both understand the competitive environment and

form the obligatory social and business networks

before fully bringing his idea to market. To map

out his market entry options, he also wants to

know which American firms are actively involved

in China’s wireless telecommunications industry,

and how they are working with Chinese companies

to deploy their solutions.

He

heard about Mapping China through one of his acquaintances

in the Silicon Valley Chinese Wireless Association

and has been sporadically using it since starting

his MBA, to track the wireless market. Today,

he enters the Mapping China URL in his Internet

Explorer browser and selects Wireless Telecommunications

from the Industries selections. He quickly skims

the overviews for each of the sub-sectors to refresh

his memory, but is especially interested in the

pie-charts depicting the market share by leading

company. Things change so fast in China that these

dynamic charts have been useful to quickly summarize

the ever-changing competitive landscape.

He

peruses potential value chain partners to further

explore in greater depth later. Interested in

the latest news with China’s leading wireless

operator, he selects China Mobile for that company’s

summary. However, he doesn’t have too much

time today to read it all, so he selects the visualization

option. This pops up a new browser window depicting

China Mobile’s large network of relationship

with other companies.

He

peruses the Chinese and foreign companies with

whom China Mobile has its key relationships, knowing

that everyone wants to partner with China Mobile

if they want to enter the wireless space in China.

(Viewing all of China Mobile’s relationships

– primary and secondary -- would be very

messy!). He also does this with leading vendors

in the handsets and wireless (middleware) software

sectors. To peruse the potential competition,

he also looks at profiles for leading companies

in wireless content and applications.

|

4.

Describe the Final Interface Design

Because

we were limited by the SIMS final project schedule,

not all of the design specifications we envisioned were

completely implemented in the working prototype. We

had to eliminate the geographic visualizations in favor

of more fully developing our user interface design and

relationship visualization, which we decided was our

application’s most important feature.

Our final user interface design consists of the following

elements:

• home page with company quick-search function,

industry drop-down selector box, links to lists of companies

(alphabetical and by industry), and short-cut to relationship

visualization (general industry visualization);

• company search results page with industry/sector

affiliations;

• industry overview/trends page with links to

industry sectors;

• sector overview/trends pages with market share

breakdown and list of companies in that sector;

• company profile pages with business and financial

summaries, key statistics, top competitors, contact

information, and link to relationship visualization

(company-focused visualization);

• relationship visualization showing

-

industry/sector associations;

-

market size of sectors;

-

competitive relationships between companies;

-

joint venture relationships among companies;

-

company mergers, acquisitions, and divestitures;

-

strategic affiliations among companies;

-

contractual relationships;

-

product information; and

-

key company statistics.

5.

Design Evolution

Our

design has gone through several iterative rounds of

design and testing increasingly refining a feasible

scope given our time and resource limitations. Our original

Low-fi design helped define an initial scope for our

project as offering competitive information. Our second

(interactive) prototype defined our differentiating

factor -- the data visualizations -- but with perhaps

to broad and ambitious an offering. It has become the

grand vision for our project, should we move ahead further

with it. Instead, we focused on the implementation of

one of the visualizations, that of the company and industry

sector relationships.

Low-Fi

Prototype Design and Testing

Picking up on a common goal of our users, we chose to

focus our first design prototype on providing a quick

competitive overview of the wireless telecommunications

industry in China. Such analysis would not only supply

summary information about an industry or sector but

also identify supplier, customer, partner, and competitive

relationships (a “five forces” analysis).

There currently appears to be no simple, online way

to accomplish this. Current alternatives include loosely

structured Internet searches (typically using Google)

and phoning industry analyst friends (as described by

Stella, one of our sample users). We also presented

mapping features, news feeds, and general city information.

We devised two major design concepts, one resembling

a portal (Prototype A) and one centered on a search

function (Prototype B). (See Appendix H for descriptions

and screen shots of these prototypes.)

Because we were still refining the scope, our primary

goal for the “low-fi” design and testing

phase was to put our ideas into an interface context

— make them “real” — and then

get feedback on content and placement. While we didn’t

apply any formal metrics to the test and responses,

we looked to users to shed light on a number of issues:

•

what users thought of the “five forces”

business analysis concept;

• how users wanted to enter the site, either

through a portal or a search interface;

• how intrigued people were by a mapping feature;

• what things users would like to see mapped;

• how helpful news is and how is it best categorized

and displayed;

• whether city information is useful; and

• how users would use a search function.

Our tests

also provided us with crucial basic information, such

as the need to use the same web page format for industry,

sector, and company overview pages, group relevant information

currently in a sidebar with the main page, and provide

a more hierarchical and apparent way to “drill

down” for information.

The most

important result of our usability testing was seeing

which features users viewed as most central to our application.

We offered mapping, job information, news, and general

city information as well as industry analysis, and the

consensus seemed to be that if “five forces”

or competitive analysis was the key component of our

tool, we should dispense with some or all of the other

features. Our users’ reactions and feedback shifted

our perspective back to focusing on this core element.

Based on

this and other observations, we ranked the various features

in terms of importance:

1. competitive industry analysis / efficient, flexible

search function

2. news

3. maps

This ranking

drove further refinement of our design. We merged the

home pages of the two prototypes and more prominently

featured the industry analysis element, better-classified

the industry categories, and honed our intended searching

function to allow users to search within selected keyword

categories. We also began to develop a more interesting

and sophisticated way to visualize and implement the

competitive analysis. We eliminated the “City”

section of our site and reevaluated how we’d present

news. We began to think about better, more apparent

ways to hierarchically structure industry and company

information and refine the list of data we wanted to

include for each. At the most basic level, we standardized

the design of the pages and considered how to present

them, whether as pop-ups or other panes or by using

frames.

First Interactive Prototype

We found,

when faced with putting together an interactive prototype,

that we had some logical holes in our project concept.

We had shifted our focus to providing users with competitive

analyses of high-tech industries. However, from the

beginning, our users have complained about the text-heavy

nature of web sites on China and Chinese companies.

We soon realized that our competitive advantage would

be in offering something other resources don’t

— namely, graphic visualizations of industry and

company data.

We therefore

redesigned our application to feature geographical maps

showing industry concentrations, company clusters, company

locations, etc. as well as graphical visualizations

showing company alliances, about which users can bring

up more detailed information. We came up with the idea

for showing this information after looking at the Faulkner’s

Advisory for IT Studies database, which has extensive

data on company partnerships, contracts, and products/competitors.

This met one of the user needs we identified in the

needs assessment phase, which was to see which companies

were working together. We also considered adding quantitative

visualizations such as pie charts and other graphs to

better help users understand the market make-up of industry

sectors.

We found,

fortunately, that this change in scope did not substantially

change the foundational functionality of our application.

We kept many of the pages designed for our low-fi prototype,

eliminating the features we decided not to use (such

as the competitive analysis and news stories) and arranging

the other data around the maps and visualizations. We

still had the same types of pages — home/orientation,

search results, industry lists, industry/sector information,

company information, and (potentially) city information.

We expanded the company information pages to show the

partnerships and product/competitor visualizations.

Please see

our Master's

Final Project report for details on the design of

other components of the project.

Second Interactive Prototype

For our

second interactive prototype, we looked to build different

ways of displaying the text- and number-heavy data offered

by financial services web sites such as IDC, Yahoo!Finance,

and Faulkner’s. We had solidified the functionality

of our site to offer three types of visualization for

this data: geographic, with maps showing industry concentrations,

locations of high-tech parks, etc.; relational, with

network diagrams showing company relationships with

strategic partners, parent companies, and competitors;

and quantitative, with charts showing market share,

subscribers, total revenue, etc. The main differences

between this and our first interactive prototype were:

•

A third type of visualization — our earlier prototypes

showed only geographic and/or relational visualizations.

We revisited our user feedback notes and discovered

that some users would like to see quantitative data

represented visually, such as which companies held how

much market share in a particular industry/sector.

• No city maps — we eliminated this function,

as it fell outside the scope for this phase. At some

point in the future, offering this kind of mapping function

(a kind of MapQuest for China) might be helpful, but

that will need to be more fully evaluated.

• Table listing details of the relationships shown

on the relational visualization — users might

like to click around the visualization to explore the

company links, but might also like to see all information

(by relationship category, such as strategic alliances

or competitive relationships) laid out succinctly, and

together.

• Single page showing industry lists, company

name search box, and search results list — this

would be a more efficient use of page space, eliminating

superfluous page loading for users.

• Sidebar showing the logos of our data partners

— we had decided to try to market our visualizations

to companies like IDC, Ovum, and Hoover’s; hence,

it was important to indicate that our data would be

drawn from these companies.

Visualization Development

The goal

of the interactive geographic, relational, and quantitative

visualizations was to help users gain an understanding

of the wireless industry in China by seeing the geographic

location of companies and industry/sector concentrations,

the various relationships companies had with one another,

and the market breakdown of sectors by company. We narrowed

down the data we would show as follows:

Geographic

Visualization

The geographic visualization would be demonstrated through

maps of China. This type of visualization would map

industry, sector, or company data, in the following

ways:

• Distribution and concentration of all or selected

industries

• Distribution and concentration of all or selected

sectors in one industry

• Distribution (scatterplot) of all companies

in a sector

• Location of a company, its branch offices, and

its suppliers/distributors

Graphically,

industry/sector concentrations would be marked on the

map by a circle, and the size of the circle would be determined

by the market size of the industry or sector in that area.

An algorithm would be formulated to display the circles.

When the user zooms on a sector, the sector circle will

expand and display all the companies in that sector.

Relational

Visualization

The relational visualization would be demonstrated by

a social networking graph written in Flash that would

map company data, in particular company relationships

comprising:

• Strategic alliances:

- Mergers/acquisitions/divestitures

- Major alliances and joint ventures

- Contracts

- Competitive relationships

We

looked at social network analysis tools and implementations

to get ideas for how to design this visualization. Most

showed only one relationship, such as connections in

a Friendster network or nodes in a computer network.

However, our visualization needed to show different

kinds of relationships in order to make the application

useful. At this point, we weren’t sure we could

apply a traditional social network analysis to our company

relationship tool, but we liked the simplicity and clarity

of such visualizations and decided to give it a try.

Quantitative Visualization

The quantitative visualization would be demonstrated

by a pie chart showing the percentage of each company’s

representation in a particular sector. The visualization

would depict sector and company data. Percentage representations

would be by:

• Market share

• Total revenues

• Capital expenditures

Pilot

Usability Test

The purpose and rationale of our pilot usability study

was twofold: to see how the design, content, and navigational

flow of our second interactive prototype performed with

three proposed user task scenarios, and to formally

test for the first time our relationship visualization.

We were particularly interested in seeing how users

liked the tool overall, how intuitive they found the

control buttons and symbol legends, and what problems

or bugs they might uncover.

The test measures we used were time and number of errors.

We timed each participant for how long it took to complete

each task scenario as well as each visualization task.

“Errors” were considered to be a glitch

of some sort in the navigation or functionality of the

site, not user errors. These “error” events

will be used to make design improvements to the interface.

We learned a number of things from the pilot usability

study:

1. There are differences among users and their computer

abilities and aptitudes. More advanced users tended

to figure things out on their own; lower-level users

became frustrated more quickly with some of the tasks.

2. We needed to make the site more clear, both in terms

of navigational flow and content description. The visualization

might be simplified, with different views clearly described

and features parceled out among the different types

of views, rather than having a lot of data shown at

one time.

3. We discovered that timing the task scenarios didn’t

give us any usable metrics because the users all progressed

through the site at their own pace. Timing reflected

the user’s personality more than the functionality

of our site. The visualization test timing was a little

more successful, as users had already worked through

the task scenarios and so were more familiar with the

site’s functionality; but task times still reflected

the willingness of the user to complete the tasks. One

user abandoned tasks more quickly than the others.

4. All of our users felt that the site’s content,

other than the visualization, was too generic to be

truly useful. They wanted more in-depth analysis. But

all could see the value of the relationship visualization

feature.

5. Many errors were caused by bugs in the coding. For

future testing, the prototype should be as highly functional

as possible.

Final

Prototype

We

modified the graphic design of our final prototype to

be more consistent with that of our visualization. Features

of our

final prototype include:

-

Data

visualization

-

Industry

overviews and relationships

-

Major players by industry

-

Company data and relationships (parents/subsidiaries,

partners, competitors)

-

Resource

links (URLs, government info, associations, conferences)

Here are

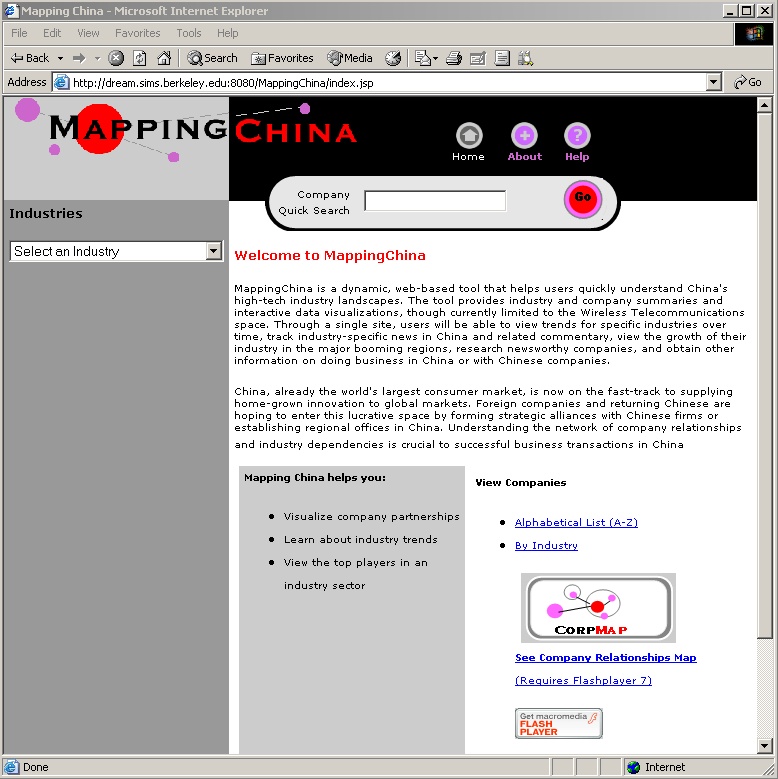

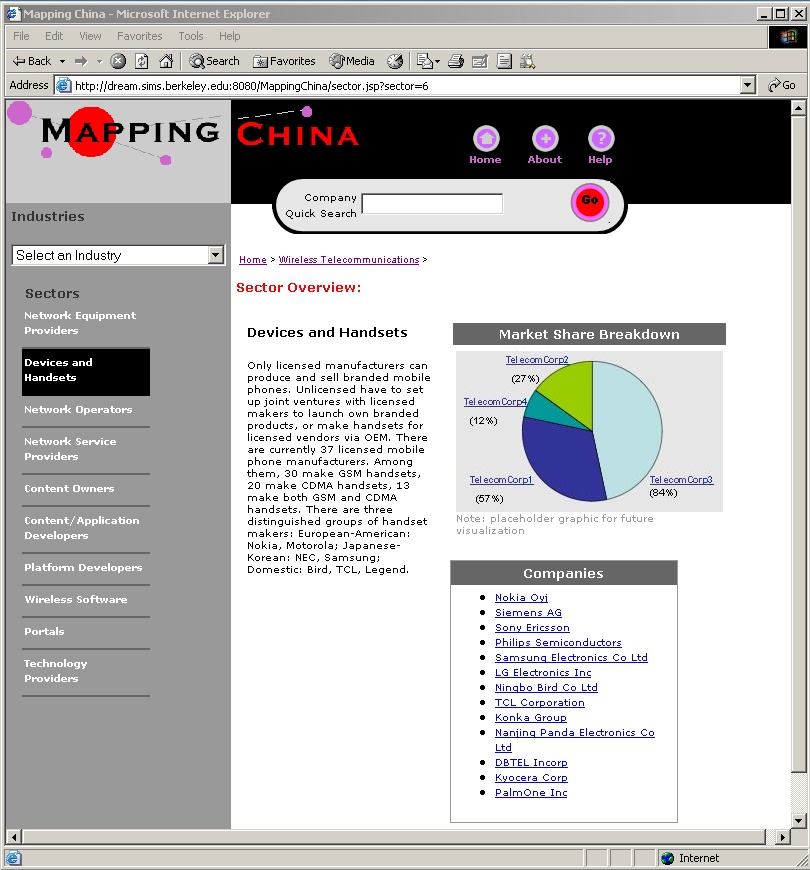

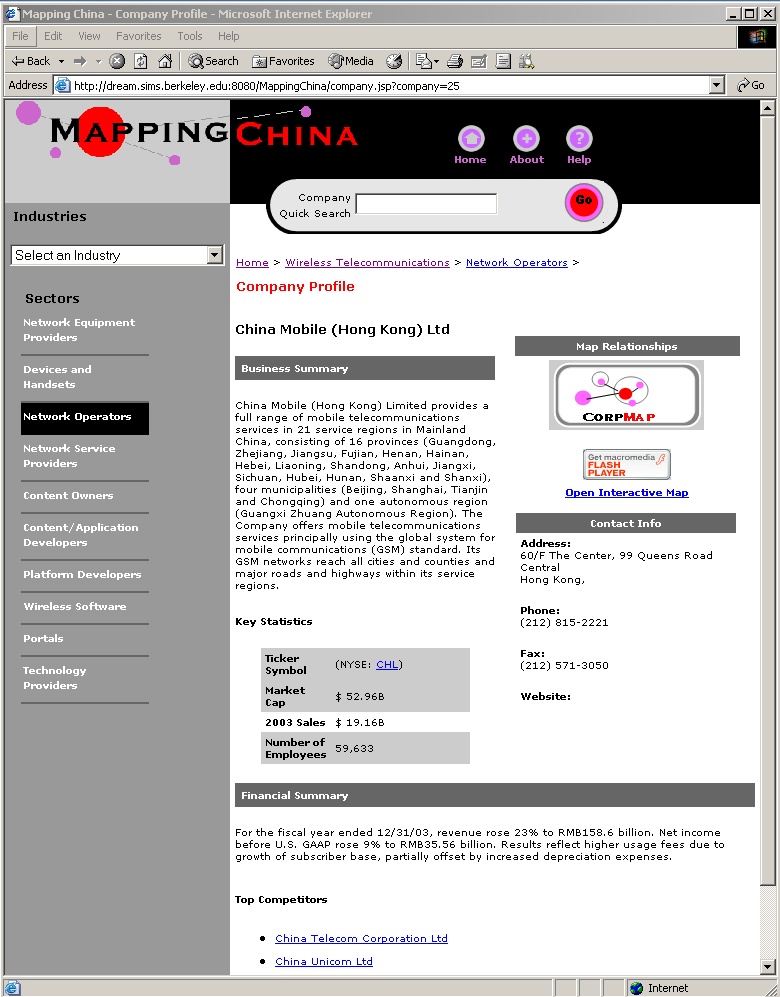

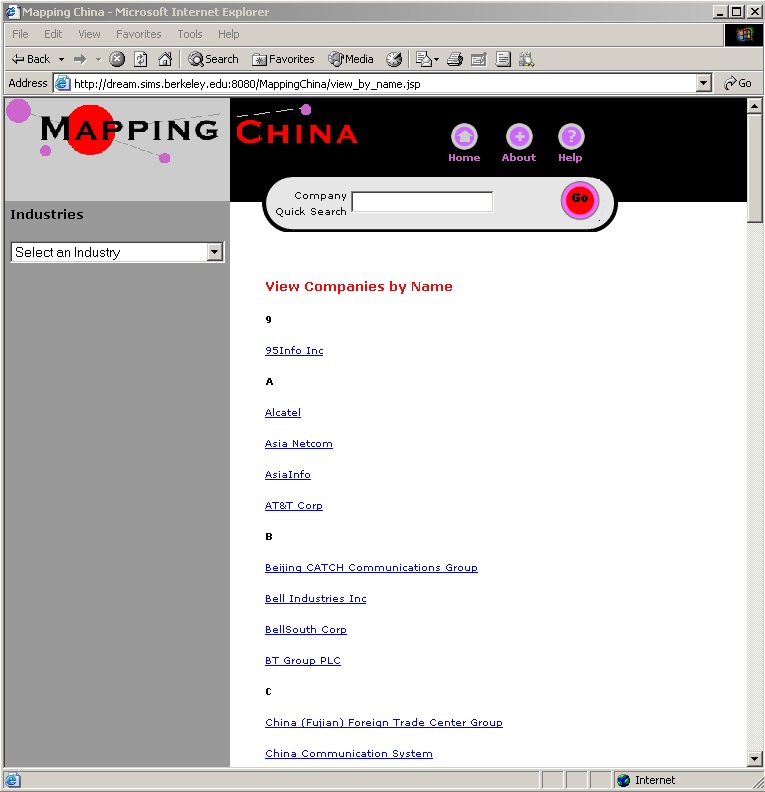

some selected screenshots from our final prototype:

|

MappingChina

homepage |

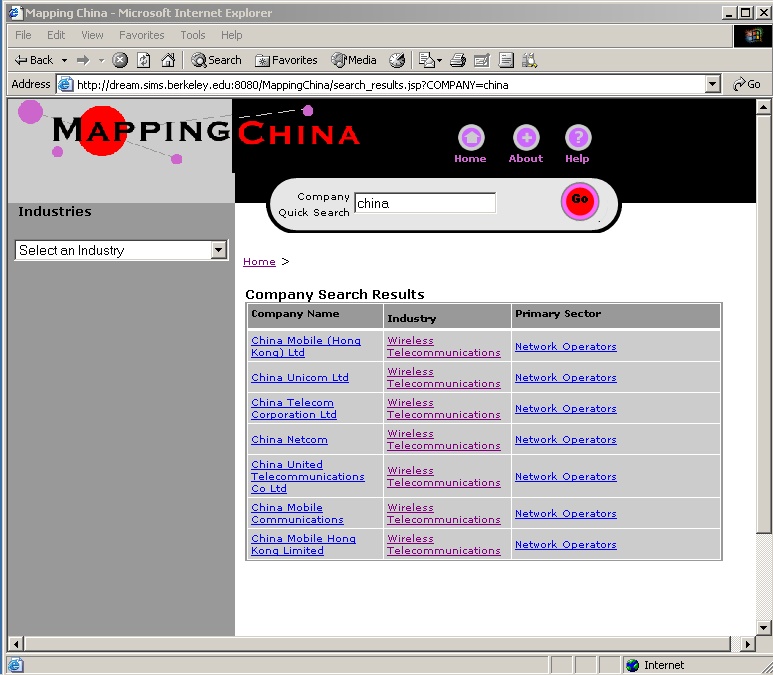

|

search results |

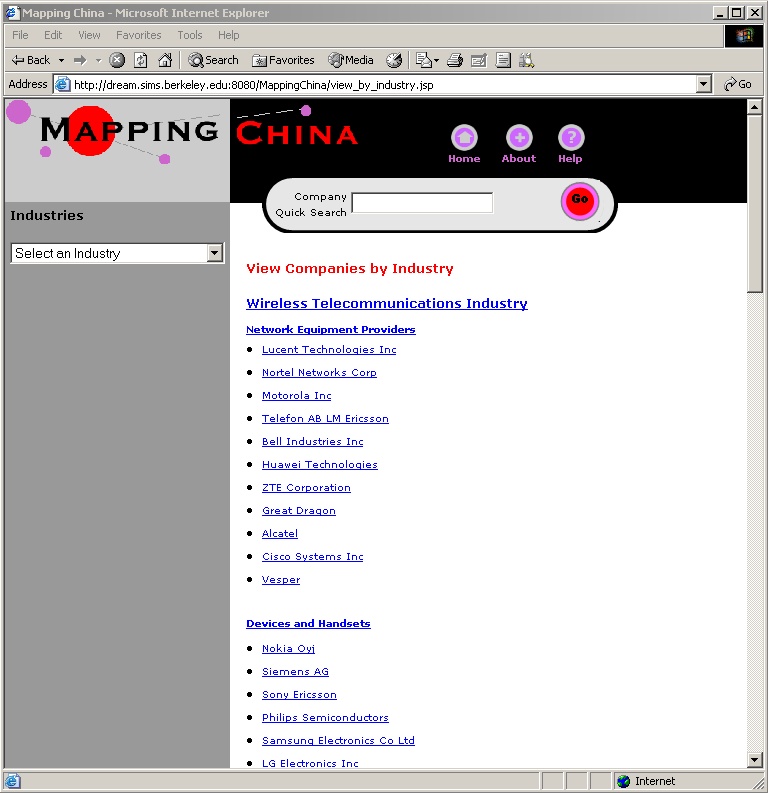

view

companies by industry sector |

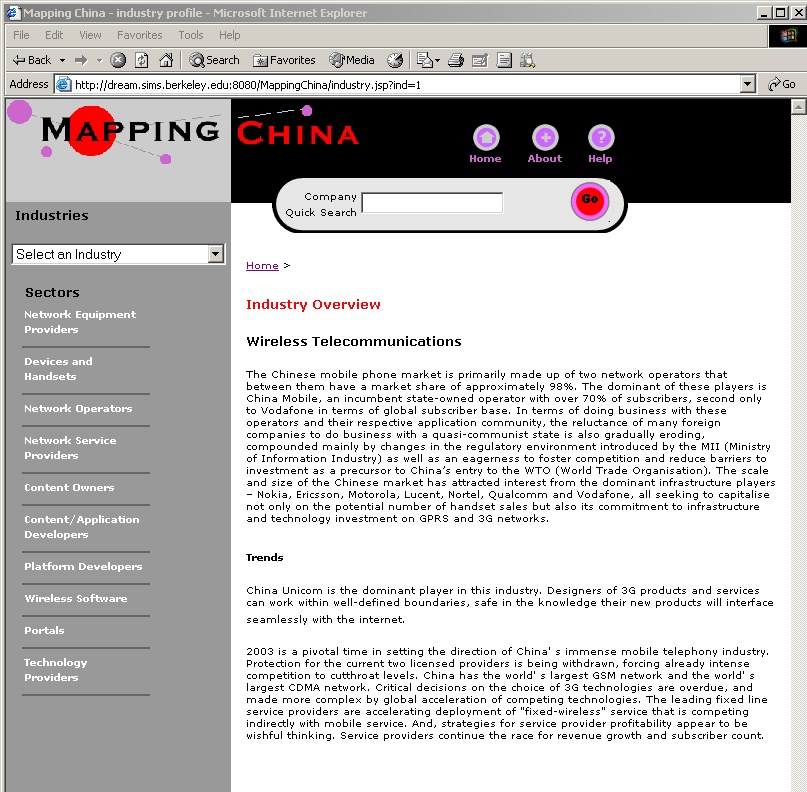

|

industry

profile |

|

sector

profile |

|

company

profile |

view

company list |

company

visualization (opens in new window) |

|

|

|