Introduction

Web

search engines are essential to web users because they provide an easy way

to locate information on the overwhelming amount of information available.

A useful search engine saves users a lot of time and effort. Many search engines

are now part of portals to drive users to their sites, so having a popular

search engine is valuable

There

is a distinct lack of quantitative research reviewing the search engine industry

at large. A quick count of the major search engines shows that there are many

more than 30 of them; however, a handful of them take up the lion's share

of the market. It is not well known what features users look for when choosing

search engines. The only research of this kind comes from NPD,

a marketing research company which conducts a survey on behalf of subscribing

search engines every quarter. This study, the

"Search and Portal Tracking Survey", is described by self-proclaimed search

engine expert Danny Sullivan as "The

most extensive survey of search engine user satisfaction available."

However,

aside from Danny Sullivan's "Search

Engine Watch" website and the press releases of companies who are happy

with their results (e.g., Google,

and Iwon.com,this

information is restricted to the search engines which have paid for the research,

and a more limited access is granted to the press. In short, with only one

survey reviewing the industry at large, and only of a very limited "group"

of search engines, very little is known about the industry. Further, given

the proprietary and confidential nature of the results, even less is known

by the general public

The

crucial question, then, as this: how much do we know about what people are

looking for in a search engine? Reviewing the NPD survey results, we find

that users are not satisfactorily queried about the various features on search

engines. Is email essential? Is the ability to structure a query in various

ways important? Are contests key? None of this is known, or can be derived

directly from NPD.

Further,

what are the most popular search engines for search? Moving toward other industry

overviews, we find that both MediaMetrix

and Nielsen

Media's "Net Ratings" (Top 10 Web Properties, September 2000) one can

pull out the search engines and come up with a reasonable estimate on the

"top" search engines. The question, however, remains - why do these search

engines dominate? What are people looking for in a search engine? For a new

entity looking to enter the search engine field: What features are essential

to the success of a search engine? What features help create a "favorite"

search site apart from the rest? With an eye toward improving search engines,

we examine users preferences regarding search engine features.

Survey

Design

This

survey was exploratory in nature. The primary goal was to examine user preference

for search engine features, as well as the relationship between search engine

preference and feature preference.

Potential

confounding variables included the participants themselves, accounting for

individual background and experience with computers, the Internet, or search

engines. To understand our respondent sample better,we also measured certain

demographic variables such as age, gender, how long participants had been

using the Internet, and how frequently they used it.

To

enable the comparison of respondents, the survey was primarily implemented

using multiple choice or check box answers, rather than open-ended or fill-in

answers. This also reduced the burden on participants and increased the "codability"

of the results. Initial pilots were performed on paper, while the final iteration

and ultimate deployment were using a web-based method. The survey instrument

was designed in several iterations. Team members drafted the initial survey,

using our own experience and other search-related survey instruments and past

research results as sources. The survey was initially piloted with 3 participants,

on paper with a team member at hand to observe and answer questions. A subsequent

iteration was piloted online, to fine-tune the survey instrument as well as

test the web-based survey for problems. Pilot participants were not participants

in the full deployment, to avoid the possibility of introducing bias in the

results.

Method

Participants

Both the subject matter of the survey (search engine usage) and its method

of deployment (web-based) required us to limit our sample to a population

that: (1) uses the Internet; (2) uses at least one search engine; and (3)

is accessible by email.

This project had access to very few resources, especially regarding the identification

and recruitment of participants. Participants were recruited by team members

from among a population of known individuals (colleagues, friends, family),

introducing the possibility of respondent bias. Thus, the generalizability

of the survey is low.

To avoid selection bias (beyond the preexisting personal relationship), we

attempted to recruit the entire population of personally-known, electronically-accessible

individuals (i.e., friends, colleagues, whose email address was known). The

sample can be characterized as relatively technically savvy, advanced users

of the Internet. Overall, this sample has been online longer, as well as more

frequently for longer periods of time, than the population at large, as we

will see when we examine the demographic data. As a result of the nature and

extent of the sampling method, these results can only be generalized to a

limited population.

Participants were contacted by email, with a link to the web-based survey.

(See the appendix for the recruitment/instructions text.) No compensation

or disclosure agreements were associated with participation in the survey,

and participants were assured of anonymity. Upon deployment, the survey instrument

was posted for 7 days before being closed to participants.

Of

a total of a sample size of approximately 100-200 , 64 participants responded

(32-64% response rate, depending upon size). The web-based survey was "hit"

86 times, and completed successfully 64 times. For the purposes of this analysis,

we assume each participant completed the survey only once.

Results

Demographic Distribution

The demographic distribution of the respondents was very limited. Overall,

respondents were primarily male between the ages of 19 and 36, who use the

Internet an average of 4-5 hours per day and report having been online for

five years or more.

|

Distribution

of Gender among respondents

N=64

|

Age distribution

among respondents

N=64

Mean=4.25(range 25-36 yrs) Std Dev=.84

|

An overwhelming majority of respondents report using the web for five years

or more. We chose the annual GVU study of Internet Usage as a reasonable measure

of the population for the purposes of comparison of our sample to the broader

population. Per the 10th GVU study,

only 37% of GVU respondents reported being on the Internet between 4 to 6

years, with nearly half the respondents reporting being online for less than

three years. Regarding hours of Internet use, approximately 34% of GVU respondents

reported using the Internet between 1-3 hours per day, and an additional 21%

reported using the Internet between 3-5 hours per day. Only 10% reported using

the Internet more than 5 hours per day. This contrasts sharply with our respondents,

of whom almost 36% report using the Internet more than five hours per day.

Even given the age of the GVU data (now more than 2 years old), and knowing

the source of the sample, this would tend to confirm that the sample is heavily

biased toward highly technical, experienced Internet users.

Length

of time using the web

N=64 Std Dev = .43

|

Hours per

day using the Internet

N=64

Std Dev=1.56

|

Information seeking: usage of the Internet and search engines

The majority of respondents reported using the Internet to find information

every time or most of the time. On this aspect our sample is in keeping with

the GVU study, where 70% of respondents reported using the Internet to search

for information most of the time. The high likelihood that the Internet is

a first resort in information-seeking behavior is further evidence that catering

to users' feature preferences may result in both a more successful search

engine and more successful searches.

|

Use of the

Internet in

information-seeking behavior

N=64StdDev=.71

|

Use

of search engines

in information-seeking behavior

N=64

StdDev=.85

|

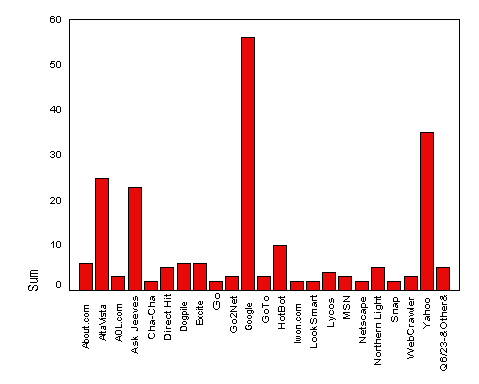

The popularity of a handful of engines became apparent upon analysis

of the data. We asked users to identify which search engines they had used

in the last year. A small number of engines showed a high frequency, corresponding

to our later findings regarding primary search engine.

Which search engines have you used in the last year?

| Search engines used in the last year |

|

Search Engine

|

Count

of Responses

|

%

of Total Responses

|

%

of Total Respondents*

|

|

About.com

|

19

|

5.2

|

29.7

|

|

AltaVista

|

45

|

12.3

|

70.3

|

|

AOL.com

|

3

|

.8

|

4.7

|

|

AskJeeves

|

51

|

14.0

|

79.7

|

|

Cha-Cha

|

3

|

.8

|

4.7

|

|

DirectHit

|

6

|

1.6

|

9.4

|

|

Dogpile

|

8

|

2.2

|

12.5

|

|

Excite

|

21

|

5.8

|

32.8

|

|

Go

|

6

|

1.6

|

9.4

|

|

Go2Net

|

5

|

1.4

|

7.8

|

|

Google

|

58

|

15.9

|

90.6

|

|

GoTo

|

4

|

1.1

|

6.3

|

|

HotBot

|

20

|

5.5

|

31.3

|

|

Iwon.com

|

1

|

.3

|

1.6

|

|

LookSmart

|

3

|

.8

|

4.7

|

|

Lycos

|

18

|

4.9

|

28.1

|

|

MSN

|

8

|

2.2

|

12.5

|

|

Netscape

|

13

|

3.6

|

20.3

|

|

NorthernLight

|

9

|

2.5

|

14.1

|

|

Snap

|

2

|

.5

|

3.1

|

|

WebCrawler

|

7

|

1.9

|

10.9

|

|

Yahoo

|

55

|

15.1

|

85.9

|

|

|

365

|

100.0

|

570.3

|

64 respondents;

0 missing/invalid

*Respondents were permitted to report up to 5 search engines.

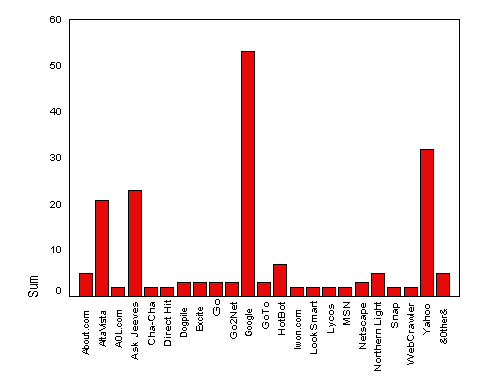

Search Engine Preference

One

of our hypotheses was that, of the multitude of search engines available,

a small handful held the greatest "mindshare". This hypothesis was

confirmed by our data. We asked respondents to identify their primary search

engine ("Q8: Please select a primary web search engine, one that you

would say that you primarily use when looking for information:" (multiple

check box options)). Of the 22 search engines listed in the survey, in addition

to an "Other/Fill in" option, a majority of respondents (89%) settled

on one of three engines as their primary engine: AltaVista, Google, and Yahoo!.

Primary

Search Engine

We sought to determine what factors played into the choice of a primary search

engine, including feature preference, habit/convenience, as well as how likely

users were to maintain a preference, once identified. We found similar aggregate

patterns among search engines used in the last year, favorite search engines,

and frequently used search engines. The distribution of most popular search

engines tracked across all these dimensions.

We were unsure about the (potentially confounding) role of habit or convenience

in primary search engine choice. The potential dissonance between frequently

used/primary engine and favorite engine was of particular concern. In piloting

the survey, we discovered a number of pilot participants who responded that

their primary search engine was not their favorite search engine, for a variety

of reasons (such as habit or convenience, or other technical constraints).

We chose to ask about both frequently used and favorite search engines to

determine whether or not a confounding variable, such as habit or convenience,

was acting on the relationship. We discovered there was a high positive correlation

(depending upon search engine, in the range of .701 to 1.0,significant at

the 0.01 level (2-tailed)) between a particular search engine being identified

as frequently used and also as favorite. (Correlational

Matrix) This correlation is also visible in the similar patterns of the

frequency distribution of the two questions.

|

Which search engines tend to be favorite?

Q6:

Please select your favorite web search engines (select up to 5):

|

| Favorite

web search engines |

|

Search Engine

|

Count

of Responses

|

%

of Total Responses

|

%

of Total Respondents*

|

|

About.com

|

4

|

2.4

|

6.3

|

|

AltaVista

|

23

|

13.9

|

35.9

|

|

AOL.com

|

1

|

.6

|

1.6

|

|

AskJeeves

|

21

|

12.7

|

32.8

|

|

DirectHit

|

3

|

1.8

|

4.7

|

|

Dogpile

|

4

|

2.4

|

6.3

|

|

Excite

|

4

|

2.4

|

6.3

|

|

Go2Net

|

1

|

.6

|

1.6

|

|

Google

|

54

|

32.5

|

84.4

|

|

GoTo

|

1

|

.6

|

1.6

|

|

HotBot

|

8

|

4.8

|

12.5

|

|

Lycos

|

2

|

1.2

|

3.1

|

|

MSN

|

1

|

.6

|

1.6

|

|

NorthernLight

|

3

|

1.8

|

4.7

|

|

WebCrawler

|

1

|

.6

|

1.6

|

|

Yahoo

|

35

|

21.1

|

54.7

|

|

Total responses

|

166

|

100.0

|

259.4

|

64 respondents;

0 missing

*Respondents were permitted to report up to 5

search engines.

|

|

Which search

engines are used most frequently?

Q7:

Please select the web search engines that you use most frequently (select

up to 5):

|

| Search

engines used most frequently |

|

Search Engine

|

Count

of Responses

|

%

of Total Responses

|

%

of Total Respondents*

|

|

About.com

|

3

|

2.1

|

4.8

|

|

AltaVista

|

19

|

13.6

|

30.2

|

|

AskJeeves

|

21

|

15.0

|

33.3

|

|

Dogpile

|

1

|

.7

|

1.6

|

|

Excite

|

1

|

.7

|

1.6

|

|

Go

|

1

|

.7

|

1.6

|

|

Go2Net

|

1

|

.7

|

1.6

|

|

Google

|

51

|

36.4

|

81.0

|

|

GoTo

|

1

|

.7

|

1.6

|

|

HotBot

|

5

|

3.6

|

7.9

|

|

Netscape

|

1

|

.7

|

1.6

|

|

NorthernLight

|

3

|

2.1

|

4.8

|

|

Yahoo

|

32

|

22.9

|

50.8

|

|

Total responses

|

140

|

100.0

|

222.2

|

63 respondents;

1missing

*Respondents were permitted to report up to 5 search

engines.

|

Feature

Importance

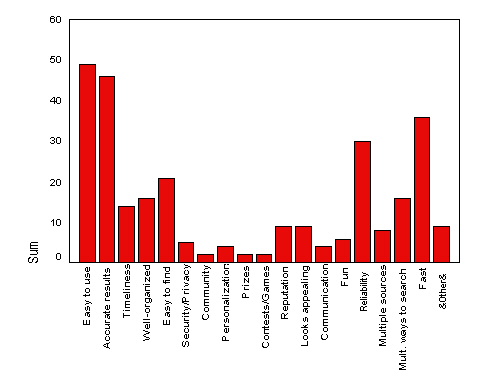

We

were interested in exploring which features attracted users to their primary

search engine. We discovered that the following features play the most significant

role in primary engine choice: ease of use and to find, accuracy, reliability,

and speed. None of these are surprising, but it is interesting that "easy

to find" ranks relatively high compared to other features.

Features and Primary Engine Choice

Q12: What features

make you use your primary search engine more frequently than others (select

up to five):

| Features and Primary Engine

Choice |

|

Search Engine Feature

|

Count

of Responses

|

%

of Total Responses

|

%

of Total Respondents*

|

|

Site is easy to use

|

47

|

19.0

|

77.0

|

|

Site has accurate search results

|

44

|

17.8

|

72.1

|

|

Site has timely, up-to-date

content and news

|

4.9

|

19.7

|

|

|

Site is well-organized

|

14

|

5.7

|

23.0

|

|

Site is easy to get to

|

21

|

8.5

|

34.4

|

|

Security and privacy

|

3

|

1.2

|

4.9

|

|

I can personalize the site,

tailoring it to my interests and needs

|

.8

|

3.3

|

|

|

Site has a good reputation

|

9

|

3.6

|

14.8

|

|

Site looks appealing

|

7

|

2.8

|

11.5

|

|

Site allows me to communicate

with other people (email, messaging, chat, postcards

|

.8

|

3.3

|

|

|

Site is fun

|

4

|

1.6

|

6.6

|

|

Site is reliable

|

28

|

11.3

|

45.9

|

|

Site allows me to search various

sources (multiple search engines, newsgroups, etc.)

|

6

|

2.4

|

9.8

|

|

Site allows me to look for inform

in various ways (Boolean, keywords, questions)

|

5.7

|

23.0

|

|

|

Site is fast

|

34

|

13.8

|

55.7

|

|

Total responses

|

247

|

100.0

|

404.9

|

61 respondents; 3 missing/invalid

*Up to five

features selected per respondent

Prompted by our findings regarding the primary engine attribute "easy

to find", the question of how users get to their primary search engine

became intriguing. We hypothesized that users might rely on bookmarks or default

home pages to access their primary search engine. However, it was interesting

to discover that users tended to access their primary search engine by typing

in the URL, over these other methods. This has implications for the "naming"

(URL identification) of search engines. In other words: the more memorable,

shorter, and easier to type, the better.

How users get to their primary search engine

N=64 StdDev=1.53

We were also interested in the "stickyness" of a search engine:

once a user has chosen a primary search engine, how likely is he or she to

continue to use it? We discovered that a significant proportion of respondents

(X%) reported using their primary engine for two years or more. We also discovered

a small positive correlation between the choice of primary search engine,

and when users reported first using their primary engine (0.203, Pearson correlation).

This may be expected, given (1) the "stickiness" factor, and (2)

that search engines launch (and launch advertising campaigns) at different

times.

"Stickyness" of a primary search engine

N=64 Mean=3.72,

StdDev=1.15

It is interesting to note gradient differences among "first use"

between the three top primary engine subgroups: users of Yahoo!, Google, and

AltaVista. It appears that users who reported Alta Vista as their primary

engine first used the engine more than two years ago, indicating a certain

"stickyness", while primary users of Yahoo! reported first using

the engine between 1-3 years ago. Meanwhile, users who reported Google as

their primary search engine are shifted significantly along timeframe to more

recently in time, reporting first use between 0-1 years. This shift in adoption

is not necessarily due to Google's relative inception date (Google was founded

in 1998), but may rather be a result of a marketing campaign or other 'buzz'

later in the timeline.

Stickyness by Primary Engine Subgroups

Again, in an attempt to ascertain how users perceive their primary search

engines versus other engines, and to further explore the possibility of confounding

variables, we asked users to compare their primary engine to others they’ve

used. The majority rated their primary search engine as much better than other

search engines. Overall, users rated their primary search engine as somewhat

better than other search engines they've used, which corresponds to the "stickyness"

of a primary search engine, once chosen.

Comparison of primary search engine to other engines used

N=64,

StdDev=.64

We also explored primary search engine choice along to the other demographic

dimensions, including experience on the web, gender, and age, but discovered

no significant correlation.