|

Home Announcements Schedule Assignments |

IS250 Computer Based Communications Networks and Systems Spring

2010 |

Assignment 3 Solutions

Assignment 3 is due at 2pm (before start of

class) on Tuesday 3/2. Please see grading

policy on course

homepage for additional details regarding early/late submissions.

Please submit your answers in plain text (no attachments) to i250hw@ischool.berkeley.edu.

1. (2 points) Suppose a malfunctioning hardware in a character-oriented transmission system sets all bits transferred to zero. Will a parity bit catch the problem? Why or why not?

Odd parity will catch the problem, because the parity bit for a data word of all zeroes should be a one. Even parity will not catch the problem, because the zero parity bit will appear to be correct for a data word of all zeroes.

2. (3 points) Why can't the CSMA/CD scheme be used over arbitrarily long distances (e.g., for WANs)?

Transmissions across long lines do not occur instantaneously. Therefore, a sender cannot be sure that the medium is idle (during carrier sense) unless it waits for an arbtrarily long time. Similarly, once a sender transmits a frame, it cannot afford to wait for an arbitrary amount of time (after the frame transmission has completed) to see if a collision has occured due to a simultaneous transmission from the far end of the medium.

3. (3 points) In the 10 Gigabit Ethernet specification, all computers must be connected via switches as opposed to hubs or repeaters. Explain why this requirement renders CSMA/CD unnecessary.

An Ethernet switch forwards a frame to the interface corresponding to the destination address specified in the frame, as opposed to broadcast the frame on all outgoing interfaces. Furthermore, if two computers transmit frames to the same destination at the same time, the Ethernet switch will buffer one of the frames while transmitting the other. Since collisions are no longer possible, there is no need for a CSMA/CD media access control scheme anymore.

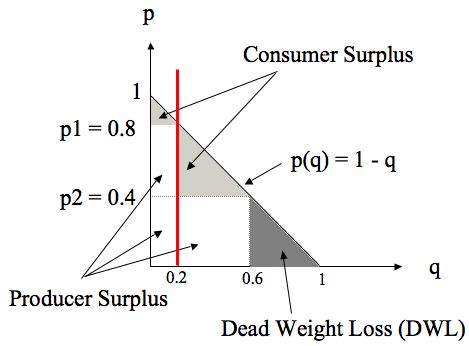

4. (5 points) In a market characterized by a cost function c(q) = c (i.e., zero marginal cost) and a linear demand function p(q) = 1 - q, we find (during our lecture discussion) that if a monopoly producer can segment the market according to consumer willingness-to-pay into two equal halves, then the monopolist will charge the high-value segment with a price p1=0.5, and the low-value segment with a price p2=0.25, realizing a producer surplus of 0.3125. (This is summarized in the table on Slide 6 of the lecture.)

(a) If instead the producer is able to segment the market as 20% high-value and 80% low value, then how should the producer set prices for each market segment to maximize its profits?

The producer should set the high and low prices at 0.8 and 0.4 to maximize the profits from the two segments accordingly.

(b) What is the producer surplus?

The producer surplus will be p1*q1 + p2*q2 = (0.8*0.2) + (0.4*0.4) = 0.32.

(c) What is the resultant consumer surplus?

The consumer surplus will be (0.2*0.2*0.5) for the high-value segment, and (0.4*0.4*0.5) for the low-value segment, for a total of 0.1

(d) What is the resultant dead weight loss?

The dead weight loss will be (0.4*0.4*0.5) or 0.08.

(e) What fraction of the market is excluded from consuming the service?

0.4 or 40% of the market.

(bonus question) (1 point) If the producer can split the market into two segments at any arbitrary boundary of q, then what is the split that will maximize the producer's profits?

Answer: Split the market into 1/3 high-value and 2/3 low-value.

Details: We can write out the equation for profit as a function of p1, noting the relationship between p1 and p2:

Profit = p1q1+p2q2 = p1(1-p1)+(p1/2)(1 - p1/2 - 1 + p1) = p1 - 3/4*p1^2

To maximize the profit, we take the first derivative of profit and set it to zero, solving for p1:

d/dp1(Profit) = 1 - 3/2*p1 = 0

This yields p1 = 2/3, and p2 = 1/3. Correspondingly, q1 = 1/3 and q2 = 2/3.

PS = 2/3*1/3 + 1/3*1/3 = 1/3

CS = 1/9

DWL = 1/18

With two market segments, the producer surplus can be no greater than 1/3.

5. (6 points) Many of the largest mergers and acquisitions in history have involved firms in the telecommunications industry. For each of the following transactions, identify the primary business of the two firms, and whether the transaction should be considered a vertical integration or a horizontal merger.

(a) Bell Atlantic/GTE to become Verizon -- $53 billion (2000)

(b) Qwest/US West to become Qwest -- $35 billion (2000)

(c) AOL/Timer Warner to become AOL Time Warner -- $164 billion (2001)

(d) Sprint/Nextel to become Sprint Nextel -- $35 billion (2005)

(e) SBC/AT&T Corp. to become AT&T Inc. -- $16 billion (2005)

(f) AT&T Inc./BellSouth to become AT&T Inc. -- $86 billion (2007)

(a) both were local telephony companies; horizontal merger

(b) Qwest: long distance voice and data; US West: local telephony; vertical integration. Note: this was a rare instance where the long distance company acquired the local telephone company. The direction is reversed in later deals, e.g., SBC acquiring AT&T in 2005. But this also speaks to the relative weakness of the local telephony market in the Mountain region. In order to complete the acquisition, Qwest agreed to regulatory demands to stop offering long-distance voice service within the US West territory, at least until the local telephony market in the territory becomes competitive. However, Qwest could still retain its long distance telephony business outside of the US West territory, as well as its long distance data (Internet backbone) business. So, for data services, the merged entity has access to both access and wide-area network infrastructures, not unlike AT&T.

(c) AOL: primarily an ISP; Time Warner: cable service and content; vertical integration

(d) both were wireless telephony providers (though Sprint was also long distance operator); horizontal merger

(e) SBC: local telephony; AT&T Corp.: long distance voice and data; vertical integration

(f) AT&T Inc.: local and long distance telephony; BellSouth: local telephony; horizontal merger